The house design begins, what about the $?

Principle 1: Observe and Interact:

One of the things that has stopped me from buying a house in the past is the fact that I would have needed to get into a lot of debt. A lot of debt would mean that I would have to work hard in a job that earned a pretty good income. My background is in advertising - which can generate a reasonable income if you play the game - I find the work quite challenging, not because it's particularly difficult, but because I'm often put into situations where I am promoting 'stuff' that I don't believe in. I don't want to contribute to a world of more unnecessary stuff (see video below), and I've managed to avoid it for a bit over a year now. I'm managing to get by on doing odd jobs here and there and using my skills to promote what I do believe in. I see the 'stuff' that I am producing now as a bit more necessary...

I kept most of my hard earned savings in an Ethical Investment institution. I was glad that my money was supporting projects that I believed in, so my money was working for me in 2 ways - making the world a better place by helping ethical businesses prosper, and by increasing my savings. For many years the investment did really well... until the crash. I bought the house early on in the decline, about 10% below the markets peak, so I was fortunate to get out relatively unscathed.

I had been looking for an opportunity to use my savings, and the skills that I have developed over the years to put some of my ideas into practice. At the moment I am (relatively) young, skilled, able and have the enthusiasm to do something - who knows how long that will last? Then the house project came along...

When I first saw the property I thought 'hello, I might be able to afford that'. When nobody bid at the executors auction (deceased estate), I decided to make an offer. It was just about all the money that I had saved over the last 7 years, $50,000. I didn't expect to get it, as the land itself was valued as $72,000 and the reserve at the auction was $85,000, but the owners were keen to sell and counter offered with $55,000. We settled on $53,000. Part of the reason that I got it so cheap was that I wasn't attached to the outcome, and also, I didn't want to borrow money - I could only offer what I had access to.

How can I afford to do anything else on the house now that's I've spent all my money? It would have to be the worst house in town. But the location is pretty good, all things considered. Being a first home buyer I am eligible for the first home buyers grant. I received $10,000 from the government, which paid the stamp duty (taxes) and left some for beginning the project. Not long after that, the federal government raised the grant, and made $29,000 available to first home buyers who buy, or build, a new home in a rural location. I contacted the State Revenue Office and asked if I would be eligible for the new grant, if I decided to build, and they said 'YES'. The catch is that I would have to return the money that I had already received, and I would not have access to the new funding until after I got a 'cetificate of occupancy', meaning, the house would have to be completed. This is a bit of a problem. It means that I will have to find some money from somewhere.

Some banks offer special rates for first home buyers, but I found that they will not give 'owner-builders' these special rates, because to qualify for the rate you need to have received the first home buyers grant - which I can't get until after the house is finished. Hmm... also, If I borrow money from a bank I need to come up with regular payments to pay off the loan. How am I supposed to pay off a loan when I'm working on the house?

All of this is tailored to people who work a 'normal' 9-5 type job, who get paid and pay someone else to do the work for you. Not owner-builders. I don't see the point in earning money (paying tax), to pay somebody else (who pays tax) to do something that I would much rather do myself. I think what I need is to borrow $29,000 which I can then pay back when I get the house finished with the grant money. That should keep me going a while.

I met with Peter (the architect / builder) on site and we looked at the possiblity of moving the existing building to a new location, in order to make it solar passive, this would make the home more comfortable to live in and cheaper to run. Peter estimated that moving the house would cost $5,000. It was decided that it would be a better idea to dismantle the house and rebuild it in it's new location - on new stumps and higher, reducing the chance of the house being damaged in a flood.

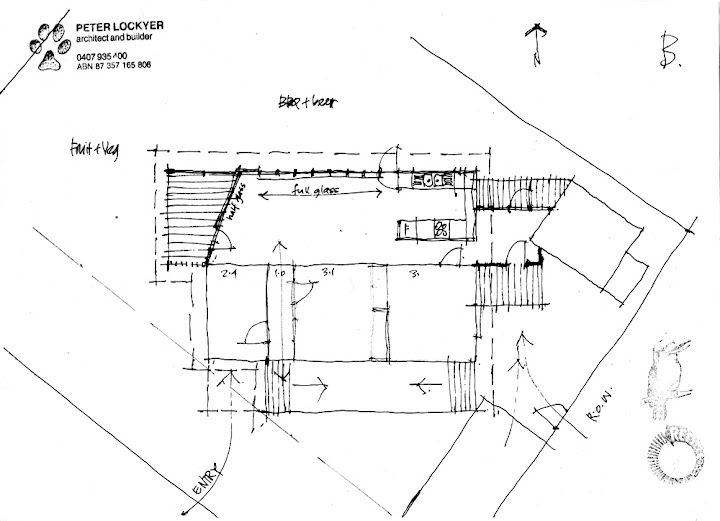

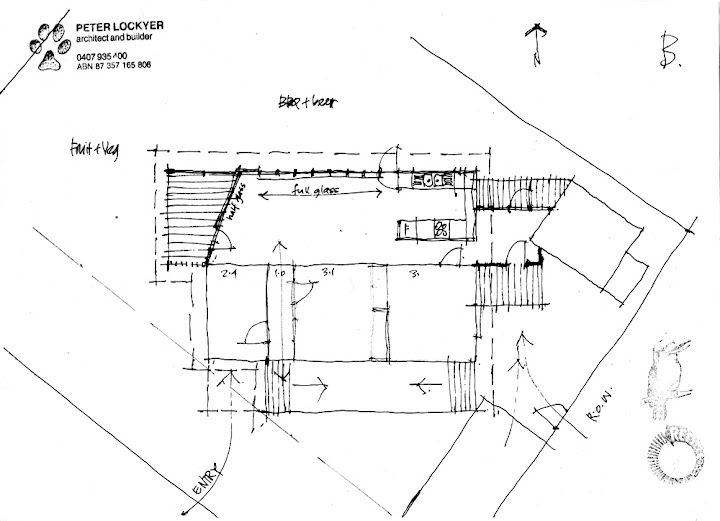

In his first sketch you can see the original house reorientated and set back towards the road. The north (top) of the house would be an extension on a slab floor with a walkway to the existing bathroom (which would be renovated).

In his first sketch you can see the original house reorientated and set back towards the road. The north (top) of the house would be an extension on a slab floor with a walkway to the existing bathroom (which would be renovated).

Peter thinks that the project will cost around $100,000 to build as an owner builder - I was hoping around $50,000. With the grant, some money that my partner was willing to put in and earning some money on the way, $50,000 seems possible. $100k... hmm...

There are also some other grants that I am eligible for that I am thinking about:

One of the things that has stopped me from buying a house in the past is the fact that I would have needed to get into a lot of debt. A lot of debt would mean that I would have to work hard in a job that earned a pretty good income. My background is in advertising - which can generate a reasonable income if you play the game - I find the work quite challenging, not because it's particularly difficult, but because I'm often put into situations where I am promoting 'stuff' that I don't believe in. I don't want to contribute to a world of more unnecessary stuff (see video below), and I've managed to avoid it for a bit over a year now. I'm managing to get by on doing odd jobs here and there and using my skills to promote what I do believe in. I see the 'stuff' that I am producing now as a bit more necessary...

I kept most of my hard earned savings in an Ethical Investment institution. I was glad that my money was supporting projects that I believed in, so my money was working for me in 2 ways - making the world a better place by helping ethical businesses prosper, and by increasing my savings. For many years the investment did really well... until the crash. I bought the house early on in the decline, about 10% below the markets peak, so I was fortunate to get out relatively unscathed.

I had been looking for an opportunity to use my savings, and the skills that I have developed over the years to put some of my ideas into practice. At the moment I am (relatively) young, skilled, able and have the enthusiasm to do something - who knows how long that will last? Then the house project came along...

When I first saw the property I thought 'hello, I might be able to afford that'. When nobody bid at the executors auction (deceased estate), I decided to make an offer. It was just about all the money that I had saved over the last 7 years, $50,000. I didn't expect to get it, as the land itself was valued as $72,000 and the reserve at the auction was $85,000, but the owners were keen to sell and counter offered with $55,000. We settled on $53,000. Part of the reason that I got it so cheap was that I wasn't attached to the outcome, and also, I didn't want to borrow money - I could only offer what I had access to.

How can I afford to do anything else on the house now that's I've spent all my money? It would have to be the worst house in town. But the location is pretty good, all things considered. Being a first home buyer I am eligible for the first home buyers grant. I received $10,000 from the government, which paid the stamp duty (taxes) and left some for beginning the project. Not long after that, the federal government raised the grant, and made $29,000 available to first home buyers who buy, or build, a new home in a rural location. I contacted the State Revenue Office and asked if I would be eligible for the new grant, if I decided to build, and they said 'YES'. The catch is that I would have to return the money that I had already received, and I would not have access to the new funding until after I got a 'cetificate of occupancy', meaning, the house would have to be completed. This is a bit of a problem. It means that I will have to find some money from somewhere.

Some banks offer special rates for first home buyers, but I found that they will not give 'owner-builders' these special rates, because to qualify for the rate you need to have received the first home buyers grant - which I can't get until after the house is finished. Hmm... also, If I borrow money from a bank I need to come up with regular payments to pay off the loan. How am I supposed to pay off a loan when I'm working on the house?

All of this is tailored to people who work a 'normal' 9-5 type job, who get paid and pay someone else to do the work for you. Not owner-builders. I don't see the point in earning money (paying tax), to pay somebody else (who pays tax) to do something that I would much rather do myself. I think what I need is to borrow $29,000 which I can then pay back when I get the house finished with the grant money. That should keep me going a while.

I met with Peter (the architect / builder) on site and we looked at the possiblity of moving the existing building to a new location, in order to make it solar passive, this would make the home more comfortable to live in and cheaper to run. Peter estimated that moving the house would cost $5,000. It was decided that it would be a better idea to dismantle the house and rebuild it in it's new location - on new stumps and higher, reducing the chance of the house being damaged in a flood.

In his first sketch you can see the original house reorientated and set back towards the road. The north (top) of the house would be an extension on a slab floor with a walkway to the existing bathroom (which would be renovated).

In his first sketch you can see the original house reorientated and set back towards the road. The north (top) of the house would be an extension on a slab floor with a walkway to the existing bathroom (which would be renovated). Peter thinks that the project will cost around $100,000 to build as an owner builder - I was hoping around $50,000. With the grant, some money that my partner was willing to put in and earning some money on the way, $50,000 seems possible. $100k... hmm...

There are also some other grants that I am eligible for that I am thinking about:

- Green Loan of up to $10,000

- Solar Photovoltaic grant of up to $8,000 for a 1Kw system

- Solar Hot Water rebate

- Water tanks and water saving systems

- Possibly ceiling insulation depending on what we do.

Comments